Form 990-N - An Overview

Form 990-N (e-postcard) is an annual information return filed by small tax-exempt organizations whose gross receipts are $50,000 or less. The deadline for filing Form 990-N is the 15th day of the 5th month after the organization’s respective accounting period ends.

- For organizations following a Calendar tax year, the deadline to file Form 990-N is on May 15th.

- Does your organization follow a Fiscal tax year? Find your due date.

If the deadline falls on a weekend or any Federal holiday, Form 990-N must be filed by the next business day.

Organizations that are eligible to file Form 990-N can voluntarily choose to file Form 990-EZ or 990 instead

Choose irs990n.org to Easily

E-file Your Form 990-N!

- Electronically filing Form 990-N (ePostcard 990) is faster and safer, where you can complete your filing in 3 simple steps with our software

- irs990n.org is an IRS-approved electronic file provider that uses cloud-based technology to help nonprofits file tax-exempt returns electronically.

- Our service ensures that your tax information is protected and reported directly to the IRS.

- irs990n.org provides step-by-step instructions to streamline your electronic filing experience with the IRS.

- We check for standard errors on IRS Form 990-N (e-postcard 990-N) to help you submit correct tax returns online to the IRS.

How to E-file 990-N with irs990n.org?

Complete your Form 990-N in 3

simple steps

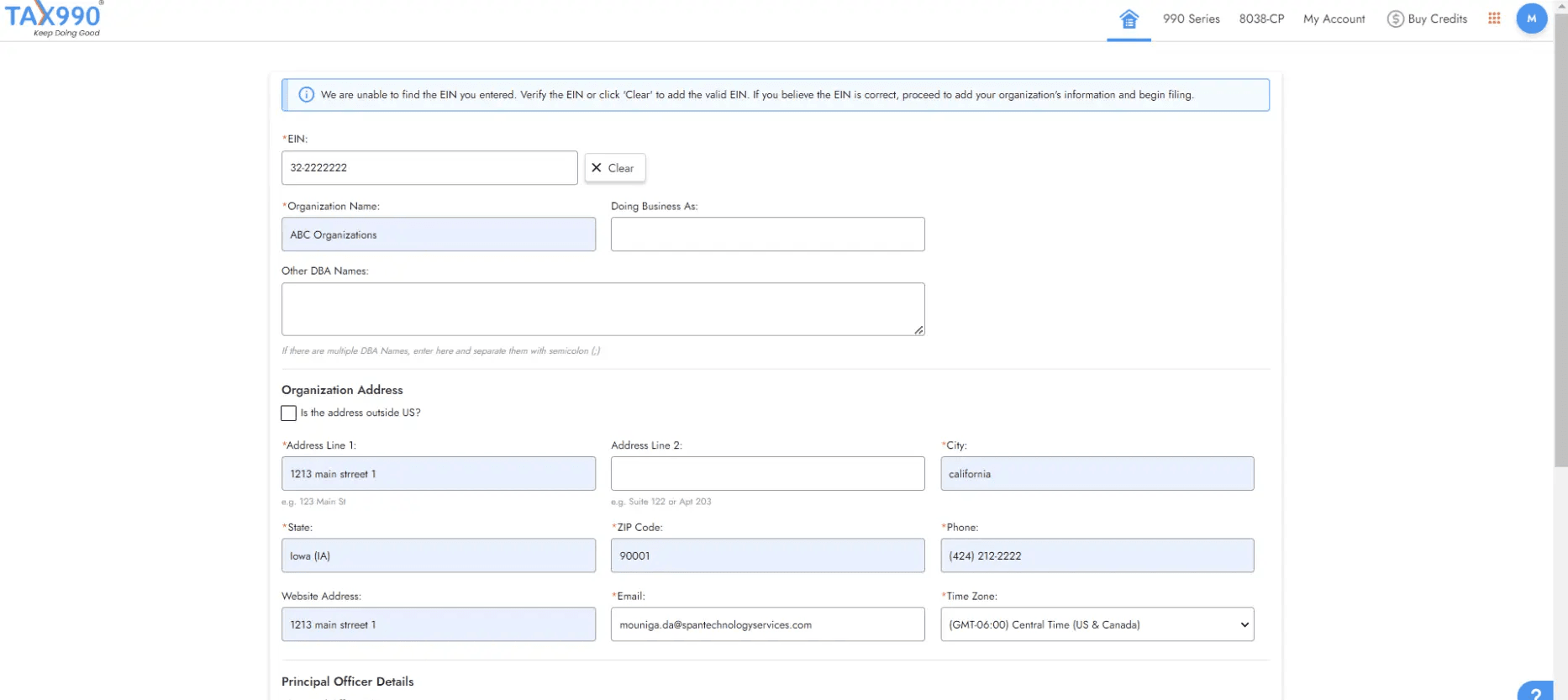

The first step to file Form 990-N with irs990n.org is to enter the EIN given to your organization by the IRS. you can view your filing history to make sure everything's on track for your organization.

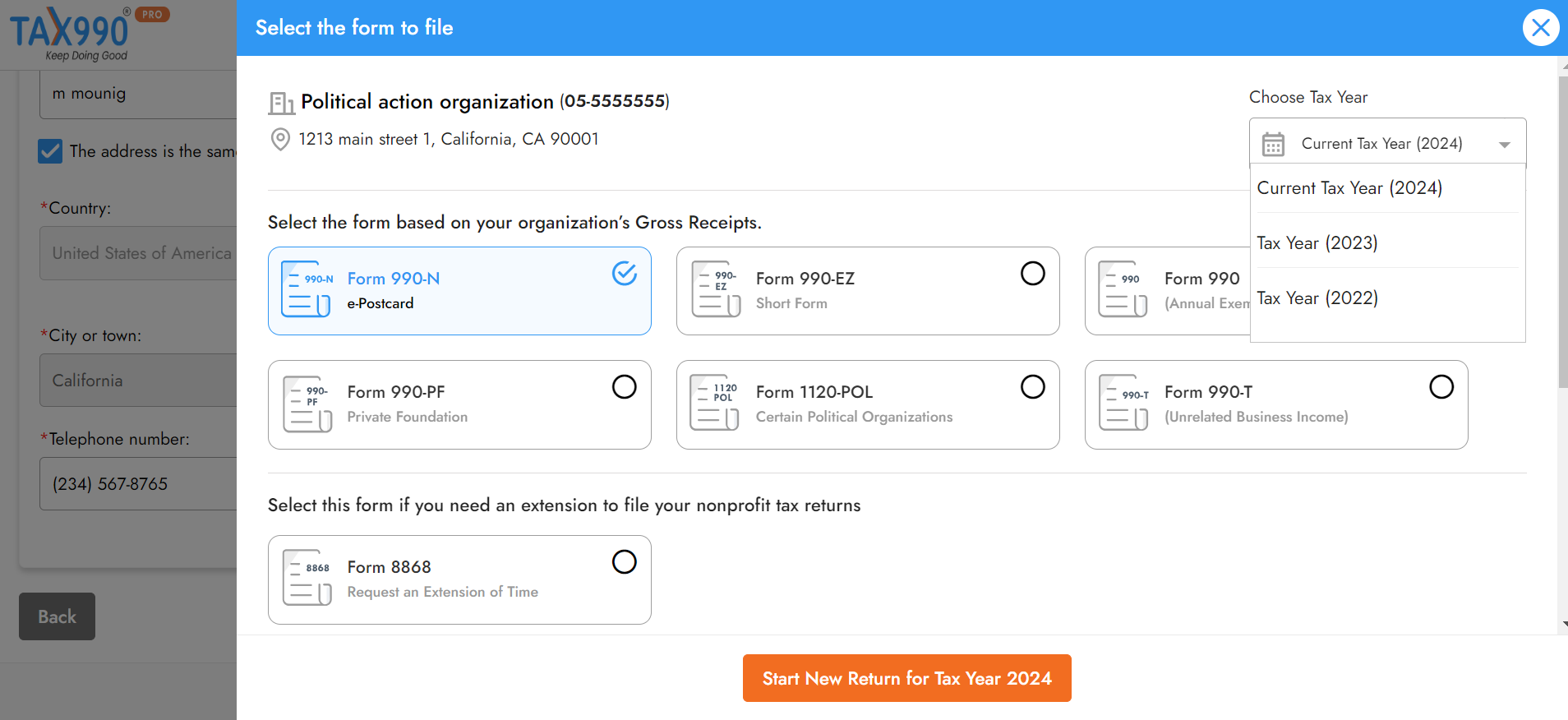

After entering your EIN, select the respective tax year for which you are e-filing Form 990-N. Irs990n.org supports e-filing Form 990-N for the current and previous tax years.

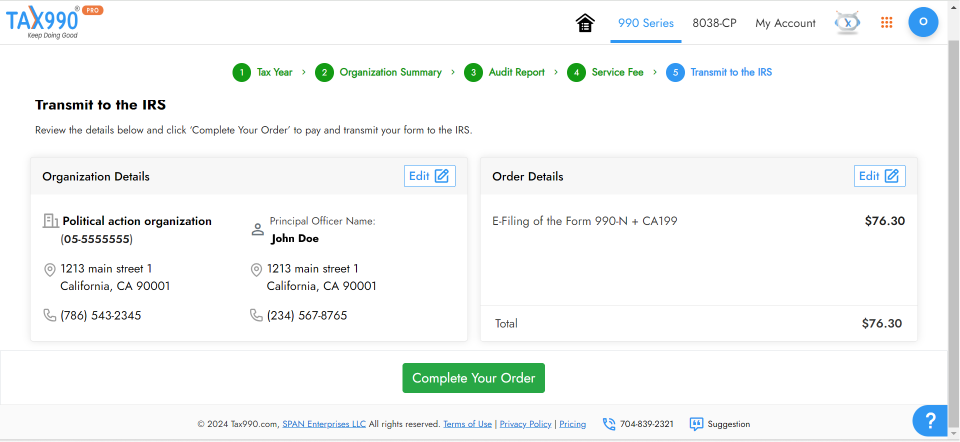

Once you’ve reviewed your Form 990-N, you can pay and transmit it securely to the IRS.

See what our clients love about Tax 990

Join Thousands of Nonprofits that Trust Tax 990

Join Thousands of Nonprofits that Trust

Tax 990

Pricing to E-File Form 990-N

- 3-Step Filing process

- File from any device

- No Subscription Fee

- Live support via chat, email, and phone.

E-File at $19.90 per return

View Detailed PricingFrequently Asked Questions on Form 990-N

Q. What information do I need to Report on Form 990-N?

A. You must report the following details on your Form 990-N:

- Organization's legal name

- Employer identification number (EIN)

- Tax year (calendar or fiscal filers)

- Mailing address

- Any other names that your organization uses

- Name and address of a principal officer

- Website address (if your organization has one)

- Confirmation that your organization's annual gross receipts are $50,000 or less and, if applicable, a statement that the organization has terminated or is terminating

Q. Can an Extension be Filed For Form 990-N?

A. No! Unlike the other 990 forms (990-EZ, 990-PF, and 990-T) , the deadline to file Form 990-N cannot be extended.

Q. Is There a Penalty for Filing Form 990-N late?

A. There is no penalty for filing Form 990-N late. However, failing to file Form 990-N for three consecutive years may lead to the automatic revocation of your organization’s tax-exempt status.

Q. Can Form 990-N be amended?

A. No! You cannot file an amended return for Form 990-N. However, Tax 990 provides you with the option to retransmit the 990-N returns rejected due to IRS errors

for Free.